Business

Unleashing the Power of Unstructured Data Governance in Banking and Insurance Sectors with Next Generation Data Governance Tools

The banking and insurance sectors have always been data-driven sectors. They thrive on data collected from various sources, including clients, employees, vendors, shareholders, and transactions. However, with the rise of the digital age and the enormous amount of data generated globally, the banking and insurance sectors are now challenged with managing unstructured data, such as emails, social media posts, videos, and chat messages.

Unstructured data, if not managed properly, can leave these sectors exposed to various risks such as non-compliance, cybersecurity breaches, and reputational damage. Unstructured data governance can help banks and insurers manage, secure and optimize their data assets.

This article will explore how a next-generation data governance tool can unleash the power of unstructured data governance in these sectors.

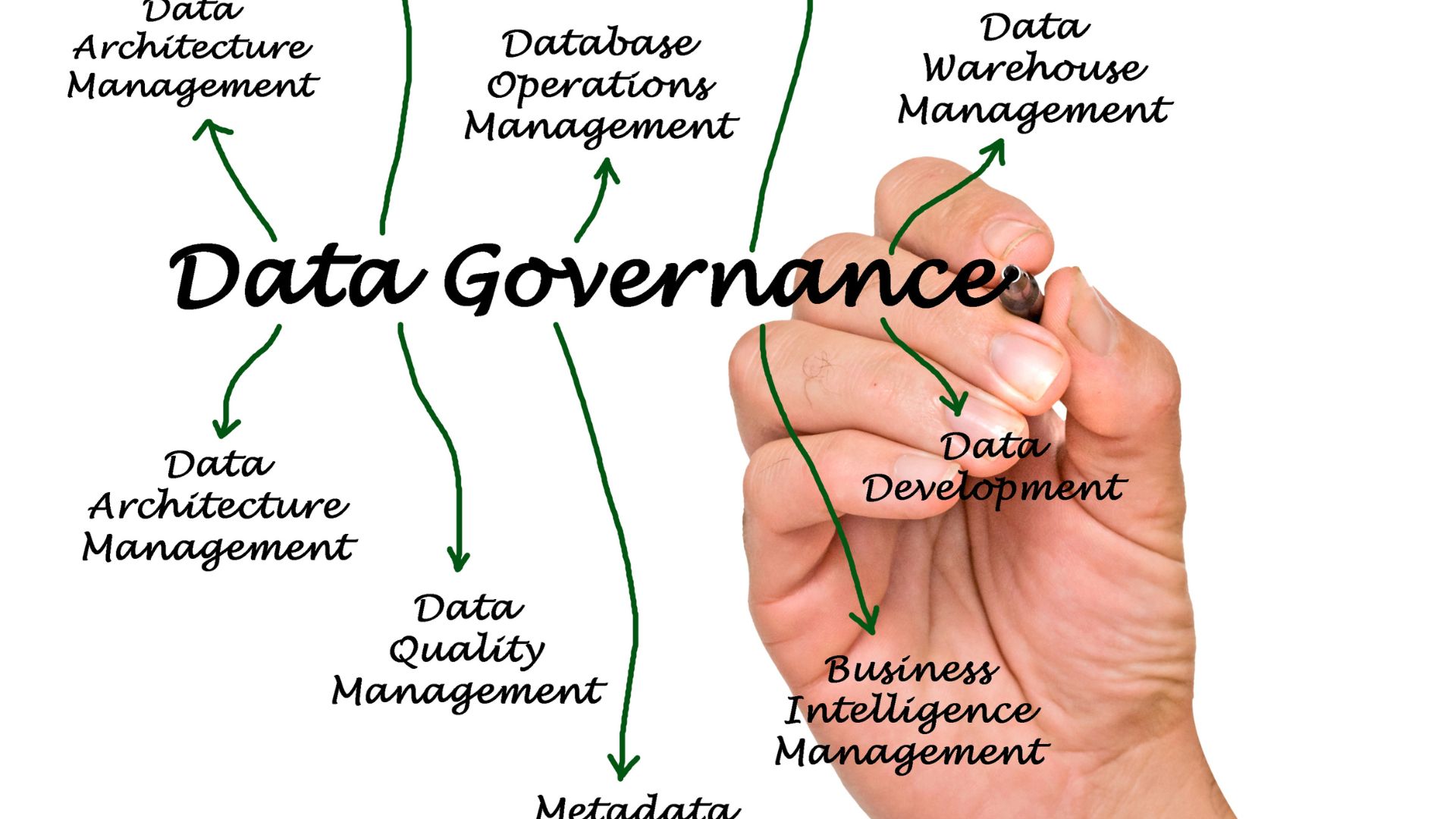

Governance, risk, and compliance (GRC) has always been an integral part of the banking and insurance sectors. The use of technology to manage structured data has been common in these sectors. However, unstructured data has emerged as a new challenge. Unstructured data is complex and can be challenging to analyze, making it essential to have the right tools to manage it. Next-generation data governance tools offer a seamless way to manage unstructured data. These tools help banks and insurers classify and manage unstructured data, providing a clear picture of sensitive data, compliance risks, and opportunities for data monetization.

The rise of big data has led to the use of machine learning and artificial intelligence (AI) in data governance. These tools help banks and insurers analyze and classify unstructured data, automating the classification of sensitive and critical data, identifying risks and opportunities in the data, and providing actionable insights. AI-based data governance tools are also designed to learn from previous decisions, making them more efficient in identifying and categorizing new data.

Data privacy and security are crucial for banks and insurers. The use of unstructured data governance tools provides a secure way to store and manage sensitive data, ensuring compliance with data privacy regulations. These tools offer robust security features such as encryption, access control, and monitoring of user activity, providing a comprehensive platform for managing data securely.

In today’s digital age, customers are increasingly using social media to interact with banks and insurers. Unstructured data governance tools can help these sectors gain insight into customer sentiment, identify trends, and develop targeted marketing strategies. These tools offer a way to analyze customer interactions, providing insights into customer needs, preferences, and behaviors in real-time. By analyzing unstructured data, banks and insurers can make informed decisions and capitalize on opportunities that may have otherwise gone unnoticed.

Conclusion

The banking and insurance sectors have always been at the forefront of data-driven businesses. However, with the rise of unstructured data and the challenges it presents, banks and insurers need to adopt next-generation data governance tools.

These tools offer a comprehensive platform for managing unstructured data, providing insights into opportunities and risks that can help these sectors meet their regulatory requirements, optimize their operations, and enhance customer experiences. The use of AI and machine learning in data governance is expected to accelerate in the coming years, paving the way for more efficient and effective data management in the banking and insurance sectors.

By investing in next-generation data governance tools, banks and insurers can unleash the power of unstructured data governance and remain competitive in the digital age.

-

Lifestyle4 years ago

Lifestyle4 years ago3 Simple Rules for Tape in Extensions Hair Care

-

Business2 years ago

Business2 years agoHow to properly develop UX design for a service product? Expert advice

-

Lifestyle4 years ago

Lifestyle4 years agoOn Spotlight: Dr. Simon Ourian, new age celebrity cosmetic doctor to the Kardashians and many others

-

Technology4 years ago

Technology4 years agoCloud hosting is not for everyone

-

Entertainment2 years ago

Entertainment2 years agoKAYLI TAKE US ON A JOURNEY WITH “make your love”

-

Lifestyle4 years ago

Lifestyle4 years agoIrish Doodles are Being Owned by Youngsters due to their Super Cuteness and Friendly Nature

-

Business3 years ago

Business3 years agoProduct Clipping Can Lead To Increase In E-commerce Sales

-

World4 years ago

World4 years agoHow US Citizens can beat Queue for Tourist or Business Visa for India